Excitement About Stonewell Bookkeeping

A Biased View of Stonewell Bookkeeping

Table of ContentsRumored Buzz on Stonewell BookkeepingFacts About Stonewell Bookkeeping RevealedThe Best Guide To Stonewell BookkeepingThe Main Principles Of Stonewell Bookkeeping The Only Guide to Stonewell Bookkeeping

Every service, from hand-made towel manufacturers to game programmers to dining establishment chains, makes and spends cash. Bookkeepers help you track all of it. But what do they actually do? It's hard understanding all the solution to this question if you've been solely concentrated on expanding your organization. You could not completely comprehend and even start to totally appreciate what an accountant does.The background of bookkeeping go back to the beginning of business, around 2600 B.C. Early Babylonian and Mesopotamian accountants maintained records on clay tablet computers to keep accounts of transactions in remote cities. In colonial America, a Waste Reserve was typically utilized in accounting. It contained an everyday journal of every purchase in the sequential order.

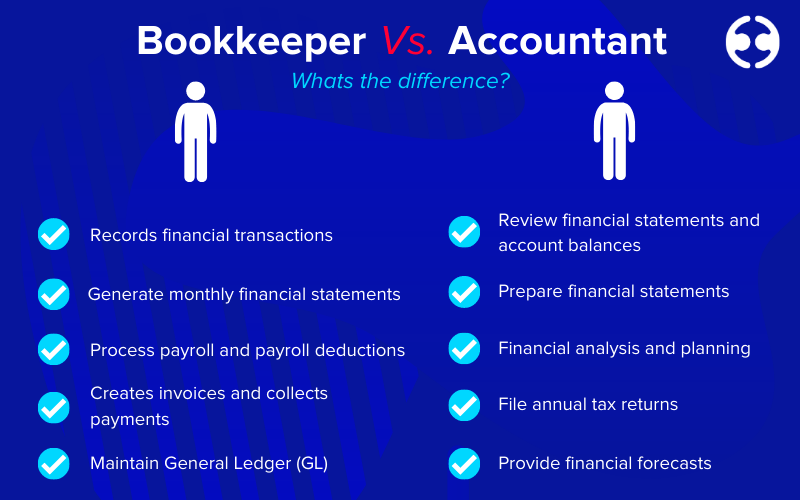

Tiny companies might count solely on an accountant in the beginning, yet as they grow, having both experts on board becomes progressively useful. There are 2 main types of bookkeeping: single-entry and double-entry accounting. documents one side of an economic purchase, such as adding $100 to your cost account when you make a $100 purchase with your bank card.

The Stonewell Bookkeeping Statements

While low-cost, it's time consuming and susceptible to errors - https://hirestonewell.creator-spring.com/. These systems automatically sync with your credit scores card networks to give you credit card purchase information in real-time, and automatically code all information around expenses consisting of jobs, GL codes, areas, and groups.

Furthermore, some accountants likewise aid in maximizing payroll and invoice generation for an organization. A successful accountant requires the adhering to abilities: Accuracy is essential in financial recordkeeping.

They usually start with a macro viewpoint, such as an annual report or an earnings and loss declaration, and after that pierce right into the information. Bookkeepers make certain that vendor and client records are constantly approximately date, even as people and services modification. They may additionally require to coordinate with other departments to make certain that everyone is using the exact same information.

Some Ideas on Stonewell Bookkeeping You Should Know

Bookkeepers quickly procedure inbound AP transactions on schedule and make certain they are well-documented and simple to audit. Going into bills right into the audit system permits accurate preparation and decision-making. Bookkeepers quickly produce and send out billings that are easy to track and replicate. This aids organizations get settlements quicker and improve cash money flow.

This aids prevent discrepancies. Bookkeepers consistently carry out physical inventory counts to prevent overstating the value of properties. This is an important facet that auditors very carefully take a look at. Involve internal auditors and contrast their counts with the recorded values. Bookkeepers can function as consultants or internal staff members, and their settlement varies depending upon the nature of their employment.

That being claimed,. This variant is affected by factors like area, informative post experience, and skill level. Consultants typically charge by the hour yet may supply flat-rate plans for details jobs. According to the US Bureau of Labor Stats, the average accountant wage in the USA is. Keep in mind that incomes can differ relying on experience, education, place, and industry.

10 Simple Techniques For Stonewell Bookkeeping

Several of the most typical documentation that companies should submit to the federal government includesTransaction info Financial statementsTax conformity reportsCash flow reportsIf your accounting is up to date all year, you can prevent a lots of stress and anxiety throughout tax period. White Label Bookkeeping. Patience and interest to detail are key to much better accounting

Seasonality is a part of any job worldwide. For accountants, seasonality implies periods when settlements come flying in with the roofing system, where having outstanding job can become a severe blocker. It becomes essential to prepare for these moments ahead of time and to complete any kind of backlog before the pressure duration hits.

The Main Principles Of Stonewell Bookkeeping

Avoiding this will certainly decrease the danger of causing an IRS audit as it provides an accurate representation of your financial resources. Some typical to keep your individual and organization financial resources separate areUsing an organization credit report card for all your organization expensesHaving different checking accountsKeeping invoices for individual and service costs separate Imagine a globe where your bookkeeping is provided for you.

Workers can reply to this message with a picture of the invoice, and it will immediately match it for you! Sage Cost Administration offers extremely customizable two-way assimilations with copyright Online, copyright Desktop, Sage Intacct, Sage 300 (beta) Xero, and NetSuite. These assimilations are self-serve and call for no coding. It can immediately import information such as workers, projects, classifications, GL codes, departments, task codes, price codes, tax obligations, and much more, while exporting expenditures as bills, journal entries, or bank card costs in real-time.

Think about the adhering to suggestions: An accountant that has actually collaborated with organizations in your industry will much better understand your particular demands. Certifications like those from AIPB or NACPB can be a sign of trustworthiness and competence. Ask for referrals or check online evaluations to ensure you're employing somebody trusted. is a terrific location to start.